oklahoma franchise tax online filing

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Complete OTC Form 200-F.

Determine the amount of franchise tax due.

. Avoid the hefty tax penalties. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. To file your Annual Franchise Tax Online.

File the annual franchise tax using the same period and due date of their. You will need to specify one tax account type for. Bench Retro gets your books in order so you can file fast.

You will be automatically redirected to the home page or you may click below to return immediately. Oklahoma Annual Franchise Tax Return State of Oklahoma Form. Filing Your Oklahoma Annual Report.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma. If a foreign corporation one domiciled outside Oklahoma has no.

If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete Franchise Election Form 200-F. Your session has expired. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Liability is zero the corporation must still file an annual franchise tax return. Fill Online Printable Fillable Blank Form 200. Based On Circumstances You May Already Qualify For Tax Relief.

You may file this form online or download it at wwwtaxokgov. You can file earlier to get a refund sooner if applicable. Free Case Review Begin Online.

Use Fill to complete blank online STATE OF OKLAHOMA. The Oklahoma Annual Franchise Tax and Annual Certificate can be filed online or by. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay.

Franchise Tax Computation. Corporations not filing Form. Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability.

To register as a new OkTAP user click the Register Now button on the top right of the OkTAP homepage and complete the required fields. Form 200-F must be filed no later than July 1. You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st.

On the Oklahoma Tax Commission website go to the Business Forms page. Online Filing - Individuals Use Tax -. After you have filed the request to change your filing period you will not need to file this form again.

Ad See If You Qualify For IRS Fresh Start Program. Allocated or employed in Oklahoma. How is franchise tax calculated.

This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. To make this election file Form 200-F. The maximum franchise tax a corporation will pay is 20000.

Form 8915 E For Retirement Plans H R Block

Should You Move To A State With No Income Tax Forbes Advisor

Missouri Income Tax Rate And Brackets H R Block

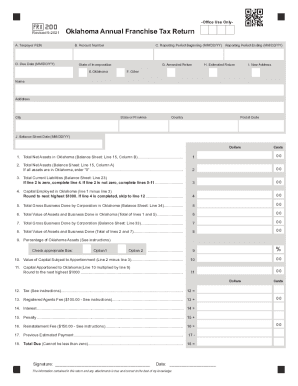

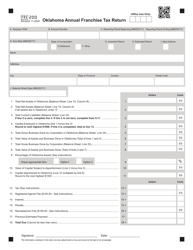

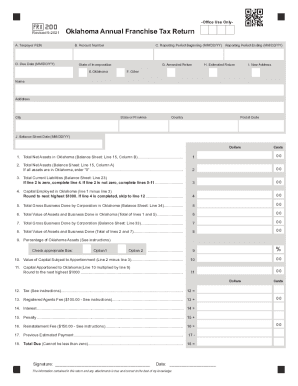

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

How To Find Your 11 Digit Sales Tax Taxpayer Number Official Youtube

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Pin By Drx Salim Ansari On Packaging And Label Design Packaging Labels Design Packing Design Label Design

When Are Taxes Due For Businesses Legalzoom Com

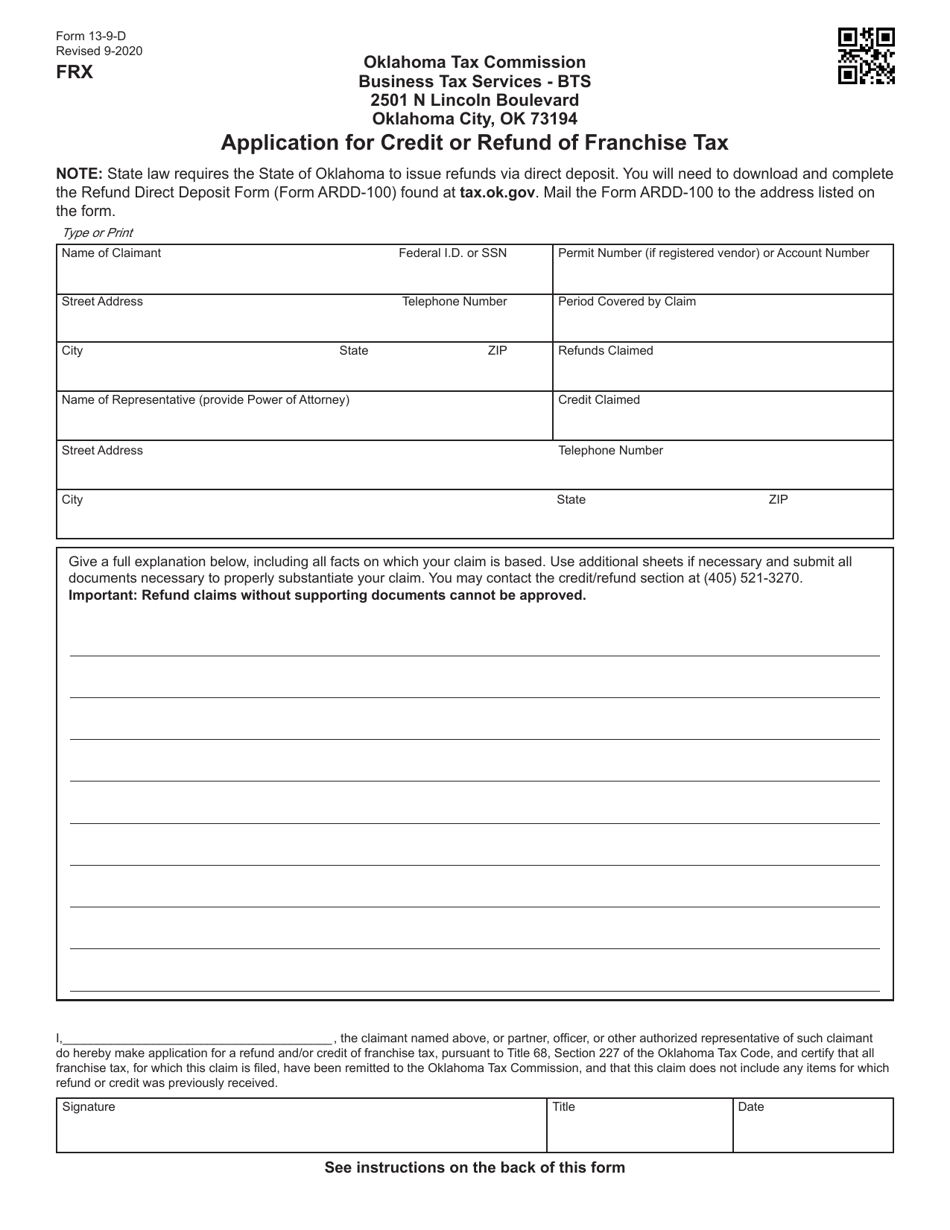

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Oklahoma Tax Commission Linkedin

Oklahoma Taxpayer Access Point

American Opportunity Tax Credit H R Block

What Is Franchise Tax Legalzoom Com

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022